The University of Lincoln provides 4 pension schemes. Please click on the links below to learn more:

×

UOL pension schemes

Additional Voluntary Contributions

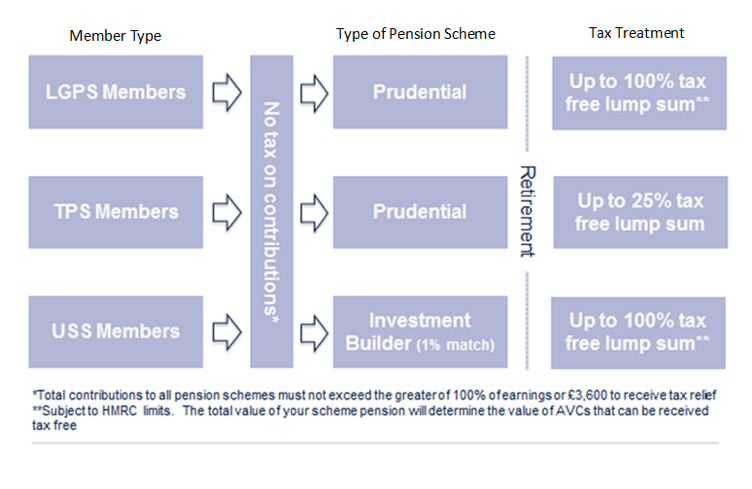

Additional Voluntary Contributions (AVC’s) are a way of building up a pot of money, in addition to your defined benefit pension. The money can be used to generate a pension income or to provide a lump sum at-retirement. It may be possible to receive part or all of these savings tax free at-retirement, depending on which pension scheme you are in.

The Tax Treatment of AVC’s

The table below shows the tax treatment applicable to each type of pension scheme. Click on your chosen pension scheme to increase your AVC pot and find out more.

Nomination forms are available from your pension website; please ensure yours is up to date.