It is generally advisable to pay off any debt (apart from mortgages) before saving money.

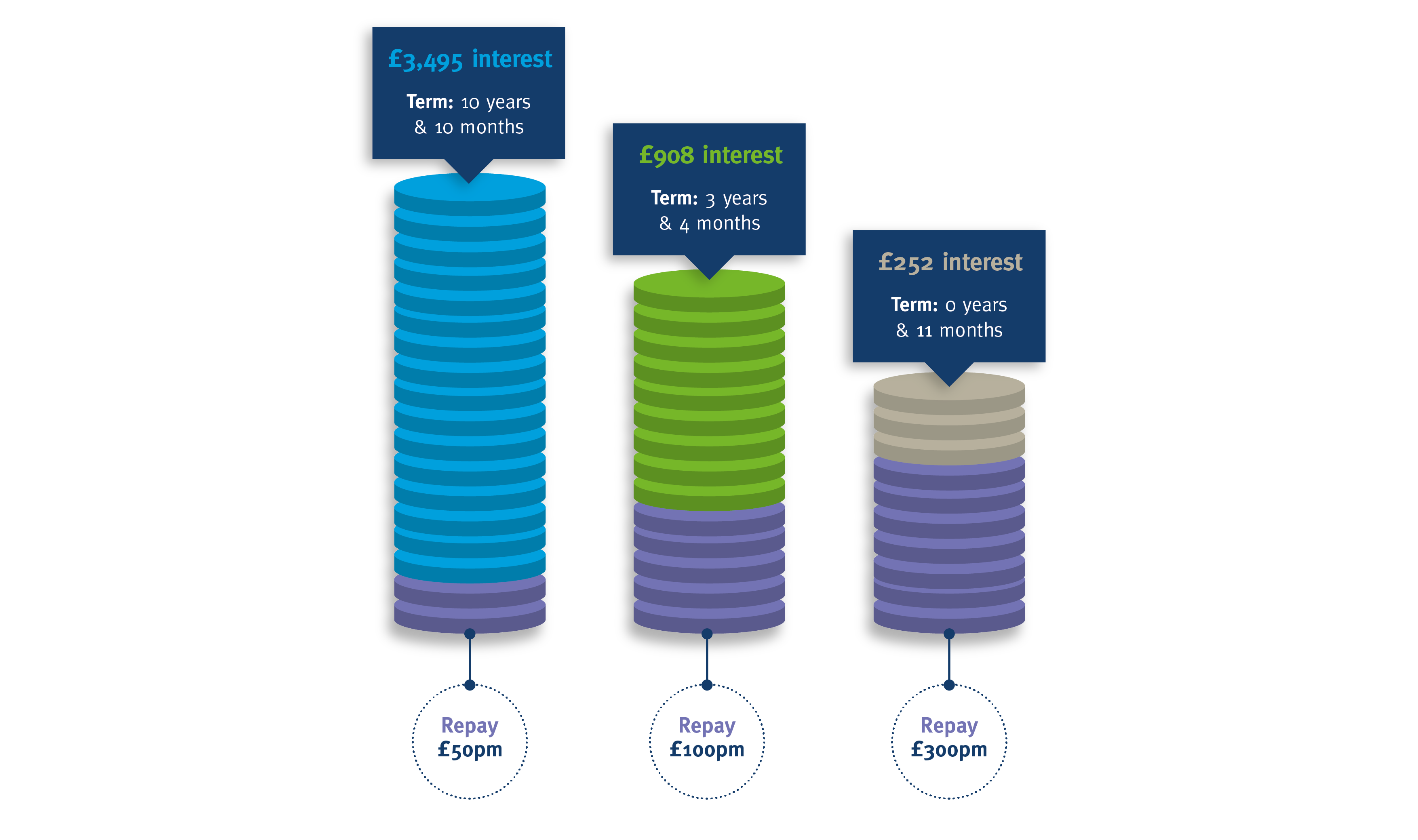

As you can see from the graphic below, saving money while still having outstanding debt can be counterproductive.

As you can see from the graphic below, saving money while still having outstanding debt can be counterproductive.

Paying off debt can be a long process depending on the scale of your debt. If you have large debts, it can be easy to give up, especially if you’re on a limited budget. Like budgeting, you need to take control of any outstanding debt by creating an action plan to pay it off. First, to create your action plan, find out each of your debts:

Once you know this information, you’ll be able to organise your debts into a list from the highest interest rate to lowest. You should attempt to pay off the debt with the highest interest rate first. Once you’ve paid off the debt with the highest interest rate you should continue to move down the list until you are debt free.

you can see what impact making overpayments towards your credit card rather than making minimum payments can have on the interest you end up paying:

For more information on the University’s Salary Finance benefit please click on the link below:

Salary Finance: https://uol.salaryfinance.