Borrowing Money

Why am I borrowing this money?

Could I save and buy the product another time?

Can I afford to pay back the money and how much will it cost me?

A good way to think about borrowing money is that you’re not borrowing money from the lender, you’re in fact borrowing money from your future self. Is this purchase worth making your future self-less well off? There could be alternatives such as buying an item second hand rather than new or getting a cheaper version of the product.

If you’ve decided that you definitely need the item and you can’t use any savings or pay for the item any other way, then you will need to look at how you should finance the purchase.

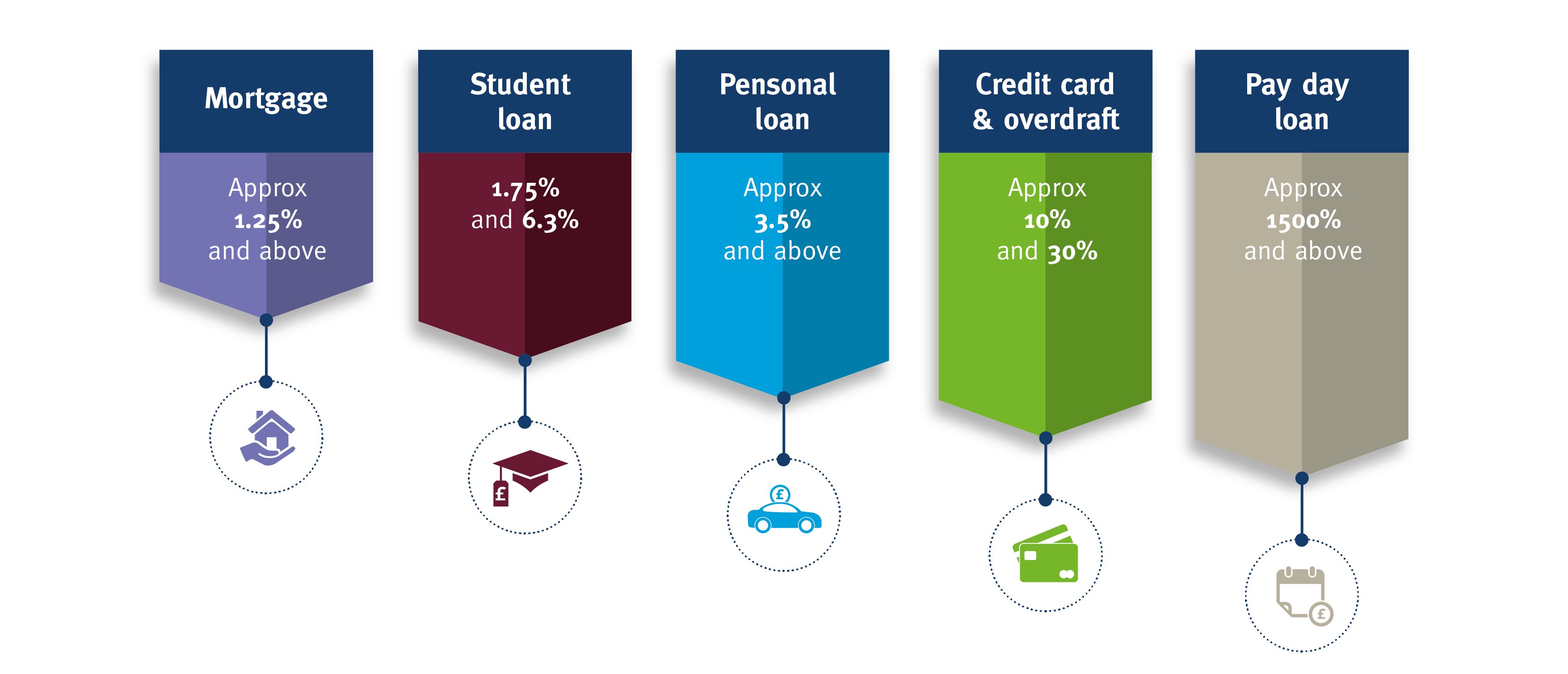

As you can see from the graphic above, rates can vary depending on how you choose to borrow.

When looking at lending money, shop around and compare deals, looking at:

- The interest rate and the APR.

- How much you will repay in total.

- The cost per month and if this is fixed or variable.

Below, some of the most common types of lending are explained.

A mortgage is exclusively used to finance the purchase of a property and it’s unlikely that you’ll be able to finance this type of purchase a different way. With mortgages, the main two types of mortgages are repayment and interest only. Both are available as fixed interest rate mortgages or tracker mortgages.

With a repayment mortgage, you are paying off the debt as well as any interest, so your debt reduces with time. With an interest only mortgage, you are not repaying the original debt, only the interest. This means that your debt will not reduce and at the end of the term you should have a way of repaying the debt, otherwise the property could be taken from you.

A fixed interest rate is more favourable if you like the stability of knowing exactly what your payments will be each month. You can also choose how long you’d like to fix your rate for. Usually at the end of that fixed rate, you’ll move to a standard variable rate set by the bank so you’ll have to renegotiate your deal again if you’d like another fixed rate.

A tracker mortgage is a type of variable rate mortgage in that it tracks a specific rate – usually the Bank of England base rate. Your interest rate and monthly payments would move in line with this rate. This doesn’t mean they are the same, just that they move in line with each other, so your monthly payments may go up or down. Tracker mortgages can be good while interest rates are low, but you are also open to the risk of interest rates rising and your payments rising too.

A personal loan could be a good idea if you need to make a large purchase and plan to pay back the money over a number of years. Most loans have a fixed interest rate, meaning you agree to pay back a set amount per month for a set period of time. Remember to shop around as the interest rate offered will vary largely between lenders and more importantly – so will the total amount you end up paying back.

If you’re looking for a short term loan for a smaller amount, a better option could be a credit card.

Although credit cards can be one of the most expensive ways of borrowing, they often have zero percent offers on, meaning you don’t pay any interest at all if you pay back the money within the interest free period.

Credit cards work by allowing you to spend up to a pre-agreed credit limit. You will normally get a statement each month, if you repay the money within a certain timescale (normally 28 days, although you could be on a zero percent offer for longer) you won’t be liable for interest. If you do not repay the money within the timescale given, then you will pay an interest rate often up to 30%!

When you’re making a purchase on a credit card, you also get protection in the form of section 75 for any purchase over £100. Section 75 means that the credit provider is responsible for ensuring that the goods you have paid for arrive and are not faulty. If either of these scenarios happen and the retailer won’t help you, you can contact your credit card provider to help out under section 75. This isn’t to be confused with insurance or a warranty. To read more on section 75 visit the money advice service.

Overdrafts are available as either arranged or unarranged, both of which can be an expensive way of lending and should only be used to fall back on in an emergency if you don’t have savings. Recent changes by the FCA mean that banks are changing the way they charge for overdrafts so you should check what your bank’s charging structure is before agreeing to take an overdraft.

Payday loans are not to be confused with regular loans. They are shorter term (often only one or two months) and crucially they charge a much larger interest rate and APR. They are also viewed negatively by most lenders so having one on you credit file can be detrimental if you’re applying for another sort of finance like a mortgage.

Payday loans are one of the most expensive ways of borrowing and should be your last resort. Not only due to the high interest rates but also due to the behaviours of many payday lenders, often encouraging borrowers to take out more loans resulting in a cycle of debt.

If you’re considering taking a payday loan think of the following:

- Do you definitely need the money now?

- Could you borrow the money another way?

- Do you have friends or family that could help?

- Check if your employer offers “Salary Finance”